Foreigners with no credit history, here’s how to get your first credit card in Boston.

What is credit history? If you do not know what that means, you do not have one. Qualifying to build credit begins with having a tax identification number - SSN or ITIN, which again, if you do not recognize these abbreviations, you need to take one step back and read this article first.

Building a US credit history - and having a score to reflect your credibility - is the first step to accessing any type of locally financed purchases from cars to homes.

So unless you envision paying everything in cash, here’s how you get your first credit card.

1. Get a secured credit card - in person or online

There is a thing called a “secured credit card” in the US- foreigners building credit from scratch, this is all we’re granted.

The secured credit card requires a cash deposit to open the account, and the deposit acts as collateral for the card issuer. Functionally they are the same as traditional credit cards, except that your deposit sum is your credit limit. Do not take offense if $1,000 is all you’re allowed… it’s tragically the same for most.

Regular credit cards are “unsecured”, so until your lender gains confidence/insight into your credit worthiness - 6 to 12 months of good credit habits - you’d not be offered one.

You have 2 options to start.

Option 1: Get a secured credit card in person, at a bank (recommended option)

Yes, I highly recommend doing this the old-school way. For one, you’d eventually need a bank account, so you might as well get one now. Two, you need a bank that you could order physical checks from - yeah you laugh thinking “who the hell writes a check in this day and age?”… America does. 🥲

There are numerous banks that offer a secured credit card; for practical reasons, go with one that has many branch locations. A bank that has a small presence becomes a big inconvenience when you’re looking for banking support (e.g. wiring money) or making withdrawals from an ATM.

TD Bank (I got my secured credit card with TD Bank and have banked with them since)

Here’s how it works:

Open a bank account. Bring:

Proof of identity. Passport or US government-issued ID (driver’s license, Green Card etc).

Proof of address. Utility bill, lease, or another official document showing your current US address.

Taxpayer identification number. SSN or ITIN.

Immigration status proof. You might need to show a visa or another immigration document.

Make an Initial Deposit: $300+

You’ll generally be approved right away, but would have to wait for your secured card to arrive in the mail to use it. 7-10 business days.

Option 2: Get a secured credit card online

If you’re looking to save a trip to the bank, there’s a ton of websites that come with recommendations, so I won’t bother to add to them- you could Google, or you could go with NerdWallet or WalletHub’s recommendations.

I do recommend having a Discover credit card, whether you choose the Secured Credit Card now or the Discover it® Cash Back Credit Card later (once your credit score is sufficient to qualify). Discover’s not widely known outside of the US, but it is over here and you’ll find its first year cash back match pretty unbeatable. It’s a staple in my wallet.

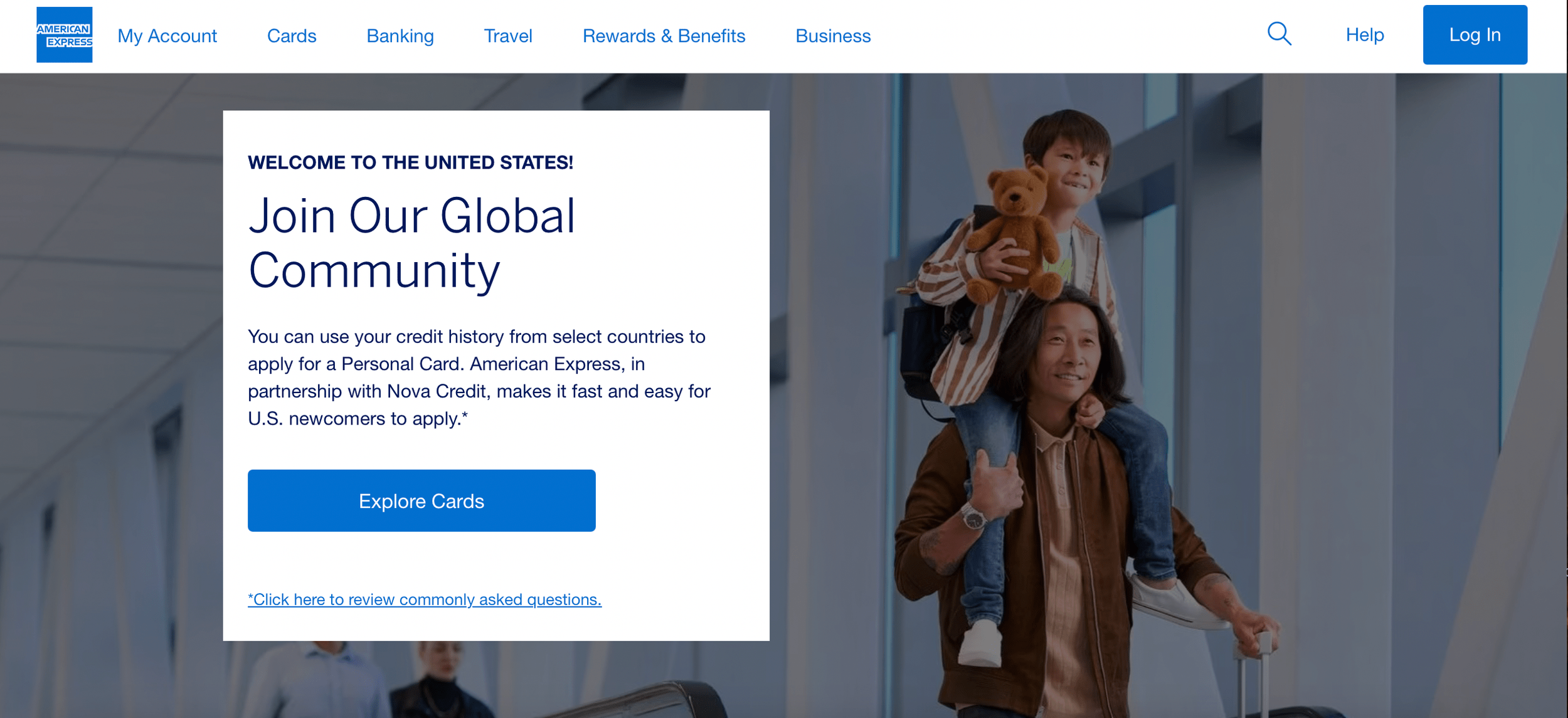

2. American Express (Amex) users, it’s time to leverage your credit history and relationship

If you’re an Amex holder from one of the below 12 countries, you could access Amex’s Credit Passport® to leverage your foreign credit history and apply for a credit card. No need to build credit from scratch!

Australia

Brazil

Canada

Dominican Republic

India

Kenya

Mexico

Nigeria

United Kingdom

Switzerland

South Korea

Philippines

If you’re not from one of the above listed countries, there’s still Amex’s Global Card Relationship.

This program doesn’t have the same fire power as Credit Passport® - you’ll have to build credit from scratch - but you will stand to receive higher starting credit limits! (See part 5 about why this matters.)

I’ve had friends approved for an unsecured card with $5,000 and $10,000 starting credit limit. Don’t grumble- it’s a nice consolation prize considering the fact that without which your starting credit limit would be $1,000.

How Global Card Relationship works:

Sign in to your pre-existing Amex account

Apply using your US address

Amex may use your account history to make a decision on your application

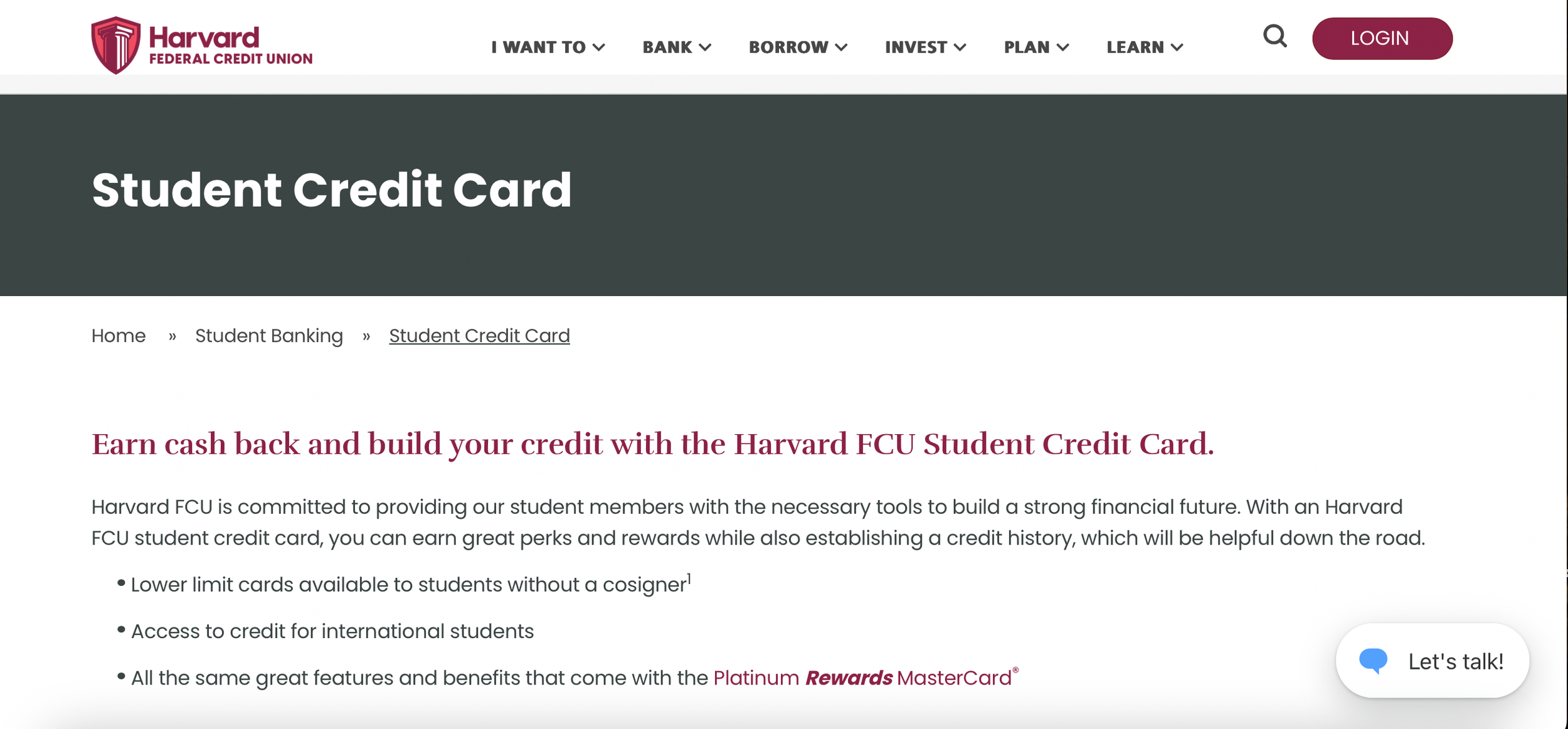

3. Students, check with your university or apply online for a student credit card

If you are a student in Boston, you may find it easier to obtain a credit card through your university's credit union, if they have one. Harvard Federal Credit Union (Harvard FCU) for example, has a Student Credit Card for both American and international students alike who do not yet have credit history in the US. For more details, you can visit the Harvard FCU website here.

Or you could once again Google “student credit card” or go with NerdWallet’s list.

4. Payroll and spending history may automatically get you a credit card

There are banks that would offer you a credit card if you use its checking account for payroll deposits - if you’ve already got a bank account set up, check to see if they offer this service.

Needham Bank does (shoutout to Barny for sharing!) - they would need a 90 days’ track record of steady payroll deposits coupled with on-time payment of bills to issue a credit card. The starting credit limit is $1,000.

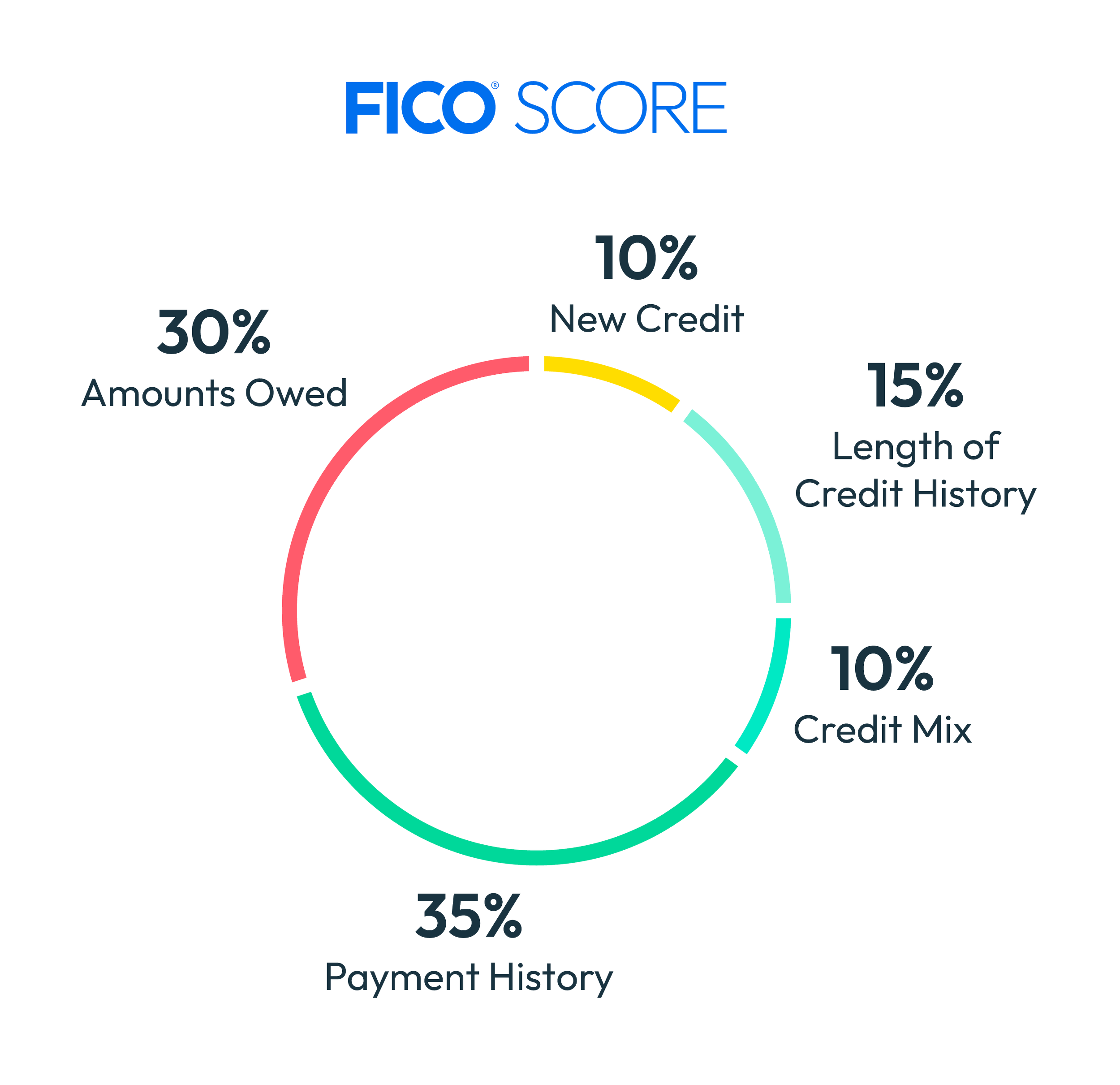

5. What goes into a credit score?

America’s system of credit scores and credit history is a complex one but there’s one logic that is simple: good borrowers are offered better financing options.

The credit score is a reflection of data points that quantify how good of a borrower you are. There are two main models that US lenders rely on to determine your creditworthiness: FICO and VantageScore.

For the sake of illustration, let’s take a look at FICO’s model. They are made up of 5 categories, each carrying a different weightage on your score:

There’s a ton of articles out there about how to manage your consumer habits, but as a first-timer to credit building with (quite possibly) a meagre $1,000 credit limit on your card, you need only to remember 2 golden rules:

Pay on time. Better yet, pay before your monthly payment is due.

Do not exceed 10% utilization. If you’ve got a $1,000 limit, do not put more than $100 on that card!